Why is family life insurance a cornerstone of financial planning? It ensures your family is financially secure if you’re no longer there.

These policies ease the burden of debts and living expenses by providing a tax-free lump sum to your dependents.

My introductory guide cuts through the complexity, giving you the essentials to select a policy that fits your family’s needs.

Important Points To Consider:

- Family life insurance provides a tax-free financial safety net for beneficiaries, including but not limited to children and spouses, covering expenses from debts to daily living costs.

- Life insurance policies have diverse options, including Level Term and Decreasing Term coverage and Family Income Benefit policies, which offer fixed or decreasing lump sum or monthly payments to beneficiaries.

- It is important to regularly review and update life insurance coverage to address changes in family needs and financial obligations. Advice from financial advisers can help you navigate complex options and tax implications.

Family Life insurance starts at only £6 per month. Compare offers from top UK insurers to ensure your family’s financial stability.

The summary tables below describe the various aspects of family life insurance, focusing on policy types, benefits, considerations, and cost factors.

Types of Family Life Insurance Policies:

| Policy Type | Description | Ideal For |

|---|---|---|

| Level Term Life Insurance | Provides a fixed payout if the policyholder passes away within a specified term. | Families seeking predictable financial protection. |

| Decreasing Term Life Insurance | The payout decreases over time, typically aligned with the decreasing balance of a repayment mortgage. | Covering specific debts that decrease over time. |

| Whole Life Insurance | Offers a guaranteed payout upon the policyholder’s demise, with premiums typically fixed. | Providing a legacy or covering funeral expenses. |

| Family Income Benefit | Replacing lost income to maintain the family’s lifestyle. | Replacing lost income to maintain family’s lifestyle. |

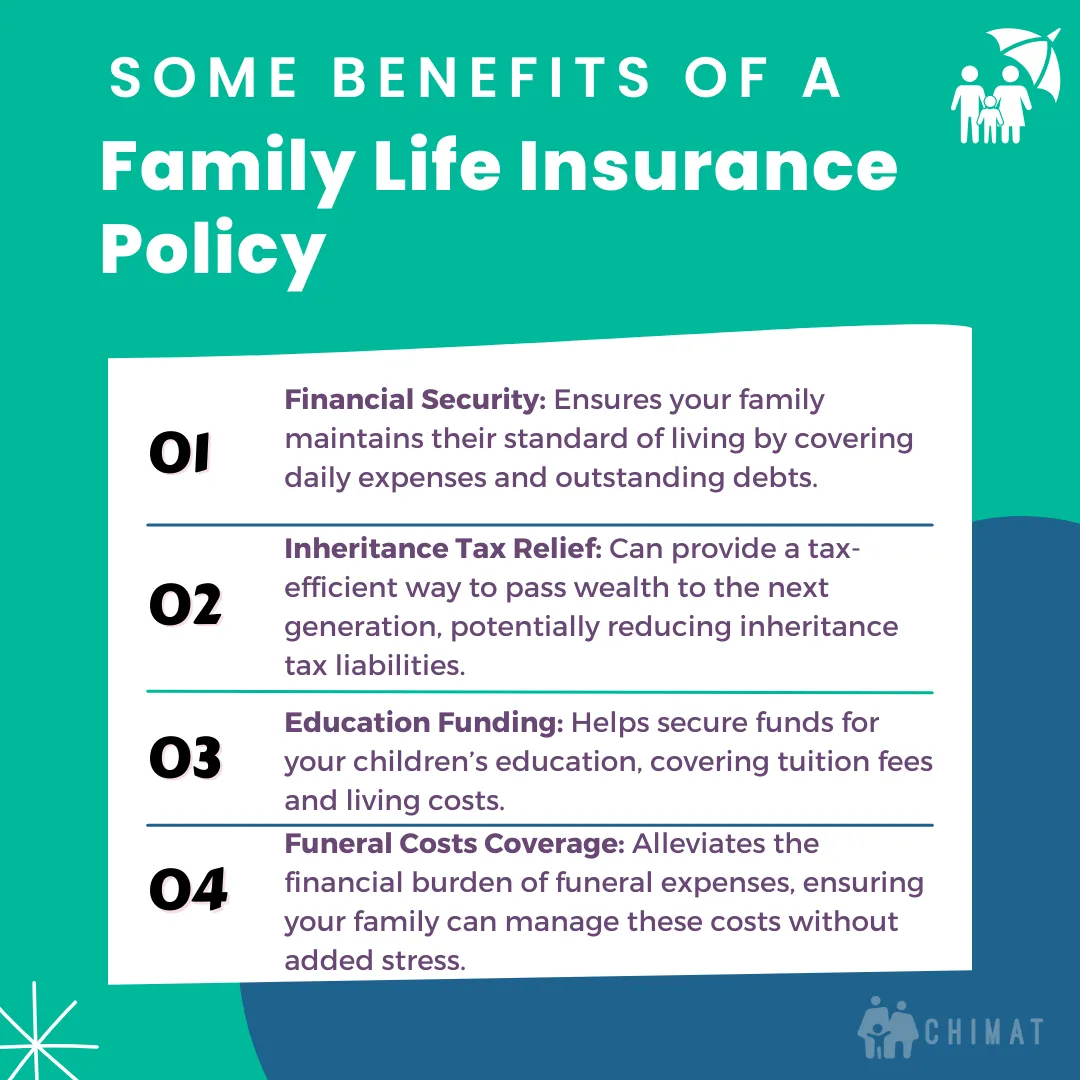

Key Benefits of Family Life Insurance:

| Benefit | Description |

|---|---|

| Financial Security | Ensures your family’s living expenses and debts are covered in your absence. |

| Peace of Mind | Provides reassurance that your loved ones will be financially protected. |

| Flexible Coverage Options | Beneficiaries receive the payout without paying income tax on the amount. |

| Tax-Free Payout | Beneficiaries receive the payout without the need to pay income tax on the amount. |

Considerations When Choosing Family Life Insurance:

| Consideration | Description |

|---|---|

| Coverage Amount | Determined by your family’s needs, including debts, living expenses, and future plans like education. |

| Policy Term | It should align with your financial obligations, such as the mortgage duration or until your children are financially independent. |

| Premium Costs | Influenced by the policyholder’s age, health, lifestyle, and the coverage amount. |

| Inclusion of Critical Illness Cover | Adds protection in case of serious illness, providing a payout upon diagnosis of specified conditions. |

Cost Factors Influencing Family Life Insurance Premiums:

| Factor | Description |

|---|---|

| Age and Health | Younger and healthier individuals typically receive lower premium rates. |

| Smoking Status | Non-smokers or those who have quit smoking for over a year often benefit from reduced premiums. |

| Type of Policy | Whole life policies generally have higher premiums than term policies due to the guaranteed payout. |

| Coverage Amount and Term | Higher coverage amounts and longer terms usually result in higher premiums. |

Understanding Family Life Insurance

Family life insurance is a shield of financial protection for your loved ones, ensuring your family’s future. Imagine it as a safety net, ready to catch your family members if the unexpected occurs.

The beneficiaries of a family life insurance policy can include your children, spouse, or other relatives. It’s a comforting thought.

Knowing they’ll have financial support even when you’re no longer there to provide it. That’s why choosing the right family life insurance plan is crucial for their well-being.

Click To Compare QuotesThis support can cover various needs, from mortgage repayment to childcare and funeral expenses. It’s like having a financial friend stepping in to help your family navigate through challenging times.

And here’s the best part: you can provide a tax-free lump sum to your dependents. This means they get the full benefit of your policy without the extra tax burden.

The Mechanics of Family Life Insurance

Family life insurance work is based on a contract of trust. You promise to make regular monthly premium payments, and your provider promises to maintain your coverage.

If you stop paying, the coverage ceases, and you may forfeit your policy. But if you continue paying, and you pass away before the policy’s expiration, your beneficiaries receive the full cover amount of your term life policy.

This payout can help manage significant debts like a mortgage, ensuring your family won’t be burdened with financial stress during an already difficult time.

Moreover, the beauty of family life insurance is its flexibility. You can expand your coverage to include the whole family under one policy.

Selecting Beneficiaries

When setting up a single life insurance policy, you can choose who you wish to protect financially after your death.

Your partner, children, or other family members can be beneficiaries.

This can help ensure that your assets are distributed according to your wishes. If both parents pass away within the one life cover policy’s term, their children, if named as beneficiaries, will receive two separate payouts, providing comprehensive financial support.

However, if you have a joint policy and wish to change your beneficiaries, you may need to split the policy into joint or single policy coverage or find new coverage.

Click To Compare QuotesAn intelligent way around inheritance tax is to write your life insurance policy in trust. This approach ensures that children beneficiaries can adequately manage the money once they reach adulthood, and the payout is not subject to inheritance tax.

Policy Payout Options

Life insurance policies are designed to support your loved ones financially when you are no longer around.

Term life insurance policies, for instance, provide a significant lump sum to beneficiaries to assist with general living expenses.

The payout options vary, with Level Term life insurance providing a fixed lump sum payout and Decreasing Term insurance paying out a decreasing but large lump sum over the policy term. Dedicated life insurance cover for mums is also available.

Alternatively, Family Income Benefit policies offer monthly payments instead of a one-off lump sum, specifically designed to replace lost income and sustain the family’s living costs.

The choice between receiving a lump sum and regular payments depends on the family’s financial planning needs.

Each option serves different financial support goals after the policyholder’s death.

Evaluating Your Coverage Needs

Determining the right life insurance coverage is like walking a financial tightrope. You must carefully balance your family expenses, outstanding debts, and mortgage payments.

Moreover, with the extra cost of of raising children and potential life changes like purchasing a home, your life insurance needs may increase.

Your chosen life insurance plan should help you find the right life insurance policy that will:

- Provide adequate income replacement for you

- Include a buffer to protect against the impact of inflation

- Be revised accordingly as your earning capacity and financial responsibilities evolve.

A Diverse Range Of Life Insurance Products

Like a well-stocked supermarket aisle, the life insurance market offers a range of products, each catering to various family needs.

- Whole life insurance offers a guaranteed payout upon the policyholder’s demise. Constant premiums and a fixed payout value characterise it.

- Term life insurance is active for a pre-defined period and pays out if the policyholder passes away within that period. Within term life insurance, you have options such as Level Term with a set sum and Decreasing Term, which aligns well with commitments like interest repayment mortgage decreases over time.

- Family Term life insurance, also known as life cover, is another popular choice. It offers fixed-duration coverage with a defined benefit if the insured passes away during this term.

- Life insurance for pre-existing conditions offers coverage, but premiums and terms depend on the severity and risk.

Adding Critical Illness Cover

Life has a way of throwing curveballs, and critical illness is one of them. A family life insurance policy can include critical illness cover, providing payouts upon diagnosis of specified illnesses.

This cover is designed to pay out and protect you if you are diagnosed with critical illnesses such as cancer, heart attack, or stroke.

If you are diagnosed with a qualifying critical illness and survive for at least ten days within the policy term, this cover provides a lump sum payout.

This can help alleviate financial burdens during recovery.

An additional feature is the Enhanced Children’s Critical Illness cover, which covers a variety of conditions, including child-specific illnesses, from birth until the insured child is 23.

This cover is generally included at no additional cost, augmenting family protection.

Consider your family’s financial needs and expenses to determine how much coverage you need.

Tailoring to Your Family’s Circumstances

Life insurance should be as unique as your fingerprint, tailored to your family’s circumstances.

For instance, a joint life insurance policy covers both partners and provides life insurance cover to the surviving partner or beneficiaries after one partner’s death.

Such policies are often more affordable than purchasing separate single policies, making them an attractive choice for some families.

However, joint policies terminate after the payout for the first deceased partner, which may not align with everyone’s needs.

Hence, these policies should be reviewed and updated to meet evolving needs as children grow and family circumstances change, including the potential to add critical or terminal illness cover.

Financial Planning with Expert Advice

Understanding the world of life insurance can be complex. That’s where a financial adviser comes in.

A financial adviser can provide tailored advice and find better value family life insurance policies, aligning the plan with your requirements.

Professional financial planning can effectively address the complexities of Inheritance Tax and utilise allowances to protect family assets.

Moreover, financial stability from a well-chosen life insurance plan can help the surviving partner maintain a balanced work-life situation, offsetting the financial stress of employment changes after a loss.

Claiming the Benefits

When the unexpected happens, claiming your life insurance policy benefits can provide a much-needed financial lifeline.

Claims can be made if the policyholder passes away during the term or earlier if they have a qualifying critical illness cover.

To claim life insurance, beneficiaries must contact the insurance provider and submit a claim form with the death certificate for the claim to be reviewed.

Once a claim is valid, the payout can help cover mortgage or rent payments, funeral costs, existing debts, and routine expenses, relieving financial burdens.

Adjusting Your Plan Over Time

Life insurance isn’t a ‘set it and forget it’ product. Regular review is required to ensure that it continues to meet your family’s evolving needs.

Your insurance policies should be updated when lifestyle or employment circumstances change dramatically, such as becoming the sole breadwinner or experiencing significant changes in financial obligations.

To maintain adequate coverage, you may need to purchase additional life insurance or consider an Age-Based policy where the premium is recalculated annually based on age and benefit amount increases.

Before choosing a new insurance provider, discussing potential adjustments with the current insurer is beneficial, as they may offer better terms or modifications to the existing policy.

Cost Considerations for Family Life Insurance

Several factors affect life insurance premiums. These include the policyholder’s age, health, and lifestyle factors, such as whether they smoke or not. Non-smokers generally benefit from lower premiums due to their healthier lifestyles.

Choosing between joint policies or a single policy can also affect monthly premiums. Single or joint policies sometimes offer a cost-saving alternative but have different implications upon a claim being made.

Whole life insurance policies are usually more expensive than term policies due to the certainty of payout, which could result in higher overall premiums paid compared to term life benefits.

However, younger policyholders typically enjoy more affordable rates, as premiums vary with the amount of coverage and term of the policy.

Preparing for the Unexpected

Life is like a roller-coaster ride with its ups and downs. The unexpected can happen at any time, making it crucial for young families to prepare for such eventualities.

Life insurance is an essential protection mechanism, providing immediate financial security for families when they face unexpected events.

Level-term insurance ensures a fixed cash payout that does not diminish in buying power over time, offering predictable financial protection.

Increasing term life insurance combats the effects of inflation by incrementally raising the protection cover throughout the policy term.

Additional optional covers, such as critical illness for the children’s cover only, enhance the family life insurance policy by offering broader financial protection and peace of mind.

Family Life Insurance Summary

Protecting your family’s future with the right life insurance policy is a vital financial decision.

Getting the right plan requires comprehensive planning and consideration, including understanding the basics of family life insurance, evaluating coverage needs, exploring diverse life insurance products, tailoring to your family’s circumstances, and even preparing for the unexpected.

Remember, choosing an entire life insurance policy is not just about securing peace of mind for you and your loved ones.

Questions Parents Often Ask:

What life insurance?

Life insurance provides a cash lump sum to your loved ones if you die before the policy ends, ensuring financial support for them. It can also include critical illness coverage.

Can I take life insurance for my child?

Yes, you can take out life insurance for your child to provide financial support in case they become seriously ill or injured, offering peace of mind and protection for your family.

What does family protection in life insurance mean?

Family protection in life insurance means setting up a plan to provide financial support to the family in case the other person dies or the main breadwinner falls ill or dies prematurely.

This coverage offers a lump sum or regular income upon these events, ensuring the family’s financial stability during difficult times.

Can you get a family life insurance policy?

Yes, family life insurance policies can provide financial support for your dependents, such as children and a partner, in the event of your passing. It typically pays a lump sum to designated beneficiaries and can be tailored to meet your family’s needs.

What is family life insurance?

Family life insurance provides financial support to your dependents in the event of your passing. Increasing life insurance offers a lump sum payout that can cover debts and replace lost income for a certain period.

It ensures your family’s financial protection and future needs are met if the worst should happen.

Can you get life insurance if you are pregnant?

You can get life insurance if you are pregnant. Most insurers do not view pregnancy as a significant health risk unless there are complications. It’s essential to disclose your pregnancy and any related medical information during the application process to ensure your policy is valid.

Can Dads Living In The UK Get Life Insurance?

The simple answer is yes. Dads can secure life insurance, and many types of plans are available. These include term, decreasing term, critical illness, and over-50s plans.

Is life insurance cheaper for women in the UK?

Yes, life insurance is typically cheaper for women due to their longer average life expectancy compared to men.