As mums, we understand our daily concern about our family’s well-being and future.

Life has a knack for surprising us, but we are here to arm you with knowledge that brings peace of mind.

Rest assured, financial security for your loved ones need not break the bank; it can start from a mere 20p a day.

Our carefully prepared guide is designed with mums in mind. It offers clear, jargon-free information on life insurance options to ensure your family’s safety net is robust and ready.

Some Important Points For Mums To Consider:

- Life insurance for mums provides a safety net, ensuring financial support for their families after they’re gone.

- Different types offer protection tailored to specific needs, such as term insurance for set periods or whole life covers for lifelong security.

- Single, working and stay-at-home mums have unique requirements that can be met with the right life insurance policy.

- Securing enough coverage to match family expenses and debts is essential in securing your children’s future.

Life insurance for Mums starts at only £6 per month. Compare offers from leading UK insurers to ensure your family’s financial stability.

Types Of Life Insurance For Mums:

| Type of Insurance | Description | Ideal for |

|---|---|---|

| Term Life Insurance | Provides coverage for a specified term. Benefits are paid out if the insured passes away during the term. | Mums looking for affordable, temporary coverage. |

| Whole Life Insurance | Offers lifetime coverage with a fixed premium. Includes a savings component that builds cash value. | Mums seeking permanent coverage with an investment component. |

| Family Income Benefit | Mums want to provide a steady income for their family. | Mums who want to provide a steady income for their family. |

| Critical Illness Cover | Provides a lump sum if the insured is diagnosed with one of the specified critical illnesses. | Mums who are concerned about financial stability in case of serious illness. |

Considerations For Mums When Choosing Life Insurance:

| Consideration | Description | Importance |

|---|---|---|

| Coverage Amount | The amount of money the policy will pay out. It should cover debts, living costs, and future expenses. | Essential for ensuring family’s financial security. |

| Policy Term | The duration for which the policy provides coverage. | Critical for matching coverage duration with family’s needs. |

| Premium Costs | The cost of maintaining the life insurance policy. | Important for budgeting and financial planning. |

| Policy Features | Additional benefits or options are included with the policy, such as waiver of premium or conversion options. | Beneficial for adapting coverage to changing life circumstances. |

Life Insurance Application Tips for Mums:

| Tip | Description | Reason |

|---|---|---|

| Compare Quotes | Look at different policies from various insurers to find the best rates and coverage. | Ensures you get the best deal for your specific needs. |

| Consider Health and Lifestyle | Your health and lifestyle can significantly impact your premiums and coverage options. | To secure lower premiums and better coverage terms. |

| Review Regularly | Life insurance needs can change with life events such as the birth of a child or a change in marital status. | Ensures your coverage remains aligned with your family’s needs. |

Understanding the Need for Life Insurance for Mums

We know how crucial we mums are in planning the family finances, yet it’s startling to realise that 64% of us across the UK aren’t covered by life insurance.

It’s a gap we can’t ignore, especially when our financial and other contributions are invaluable to our families’ well-being.

Click To Compare QuotesWhether we’re working or caring for children at home, ensuring there’s a safety net can prevent financial grief from compounding the emotional distress of losing a loved one.

That’s why understanding and addressing the need for life insurance is essential for us mums; it gives us peace of mind knowing that our families will be cared for, no matter what happens.

The role of mums in financial planning

Mums play a large part in managing money for the family. They often decide how to spend money on things like food and clothes and take care of the house.

Mums also consider significant responsibilities like paying for school or dealing with loans.

They help plan so there’s enough money now and in the future.

It’s not just working mums who look after the family’s cash; stay-at-home mums do, too. They ensure everyday costs are covered, save for holidays, and even plan when extra money might be needed.

Whether saving a little every week or making tough choices to stick to a budget, mums are essential in keeping their families’ finances on track.

Addressing the gap: Why 64% of UK mums lack coverage

We often see that many mums in the UK don’t have life insurance. This means 64 out of every 100 mums might be unable to leave money for their family if something happens to them.

It’s often because they think it costs too much, or maybe they don’t know how important it is.

Finding the right insurance deal could also be challenging for single mothers and stay-at-home mothers. They may first worry about other needs, like food and clothes for their kids.

Types of Life Insurance Available for Mums

Mums have several types of life insurance to choose from. Term Insurance provides protection for a set period;

Whole of Life Cover offers lifelong security; Family Income Benefit ensures regular income for dependents; and Joint Life Insurance covers both parents under one policy.

Each option caters to different needs, securing our family’s financial future through life’s ups and downs.

Term Insurance: Protection for a Defined Period

Life can be full of surprises, so it’s important to have a safety net for those we love. Term insurance is like a promise that keeps your family safe financially for a set time.

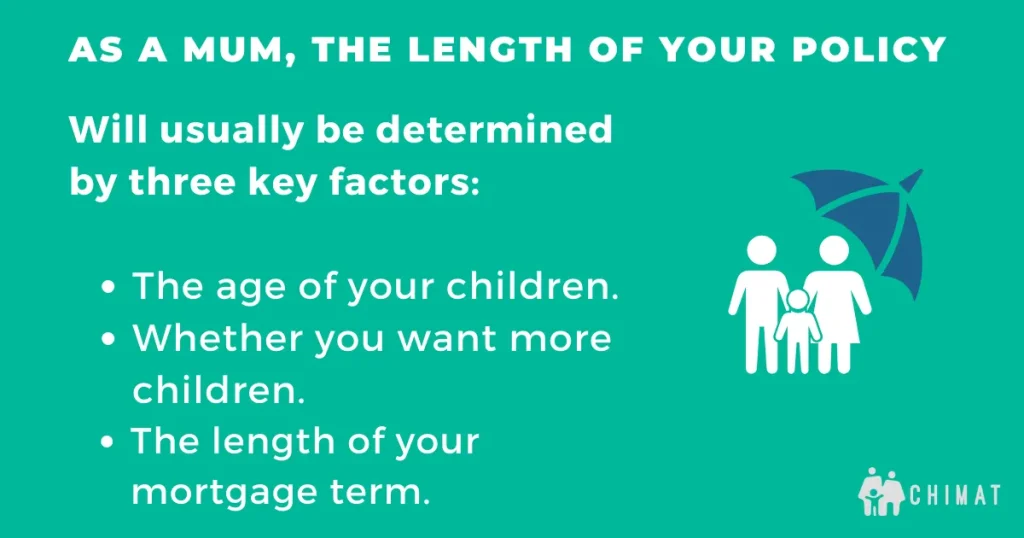

You choose how long you want this protection – maybe until the kids are grown up, or the house mortgage is paid off. It’s flexible, too; if life changes, such as having another baby, you can adjust your cover to fit your new situation.

Click To Compare QuotesGetting term insurance won’t break the bank, either. For around £6 a month, less than what most of us spend on coffee each week, you could give yourself and your little ones significant peace of mind.

Just think of it as one more way to wrap them up in security and love without stretching tight budgets too far.

Whole of Life Cover: Lifelong Security

Life insurance that covers you for all your life is called whole of life cover. This kind of plan means you can stop worrying about when the policy ends because it keeps going as long as you pay the premiums.

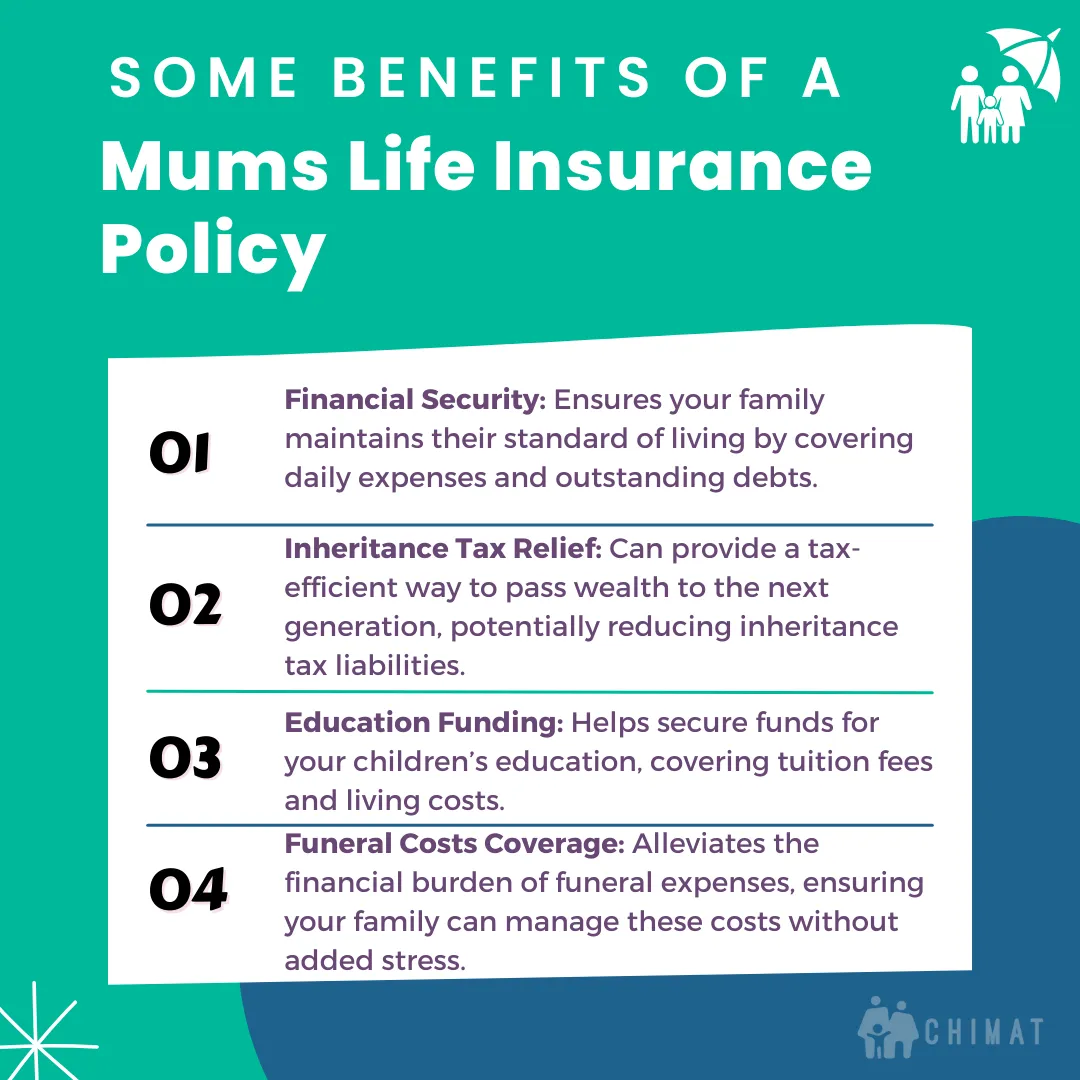

Considering this type of policy is wise, especially if you want to ensure that your family has money when you pass away, regardless of your age.

The cash from a whole life policy could help with funeral costs or leave some money behind as an inheritance for your kids.

It also makes sense if you have debts like credit cards or loans that need paying off after you’re gone.

It can be a relief to know that these will not be passed on to your loved ones, and they will thank you for thinking ahead.

Plus, setting up your policy in trust could save on inheritance tax, meaning more of the payout goes straight into their hands without any extra costs.

Family Income Benefit: Regular Income for Dependents

We know you want to ensure your family’s well-being, even if you’re not around. Family Income Benefit can do just that.

It’s a type of life insurance that gives your loved ones money every month instead of one big amount all at once.

Click To Compare QuotesThis helps cover bills and food so they can live how they’re used to.

Think about what it costs each month to keep the household running efficiently. In the UK, families spend on average £2,548 per month!

If something happened to you, Family Income Benefit could help by paying out regularly to help with those costs.

If raising kids is part of your world, remember that raising a child costs about £157,562 over 18 years.

With this benefit, their future stays brighter because they get monthly money to help with those expenses.

Joint Life Insurance: Covering Both Parents

Joint life insurance is a smart move to protect your family’s future. If you and your partner both have this cover, it means that if one of you passes away, the other and your kids will be financially secure.

It can help pay for significant costs like funerals, which I know are expensive, and make sure everyone can keep living the way they’re used to without worrying about money too much.

This type of policy also includes an inheritance amount for our children.

Plus, it keeps things more straightforward with just one policy for both parents instead of two.

Special Considerations for Different Mum Scenarios

Every mum’s situation is unique, and we understand that. Whether you’re a single mum, juggling work-life balance as a working mum, dedicating yourself to your family full-time at home, or adjusting to life as an older or expectant mother.

There are tailored insurance solutions just for you.

Single Mums: Tailoring Coverage to Unique Needs

Being a single mum comes with challenges different from those of other parents. It’s more than just looking after your little ones on your own; it’s about ensuring they’re well taken care of, even when you’re not around.

Life insurance is key for single mums because it gives them peace of mind that their children will be okay financially if anything happens to them.

As single mums, you face costs alone, which can be higher than when sharing expenses with a partner.

Click To Compare QuotesThat’s why life insurance tailored is so essential. It offers extra features like critical illness cover and children’s cover to help ease our unique worries.

We want to ensure our kids have everything they need, and the right life insurance policy helps us do that.

Working Mums: Balancing Career and Protection

Mums with jobs have a lot to handle. Juggling work and family takes skill. You might worry about keeping everyone safe while earning money, too.

Life insurance is one way to ease those worries.

If something happens, your kids still have what they need—like a warm home and school books.

Choosing the right life insurance doesn’t mean spending a lot of cash, either. Specific policies are made for working mums like you. They offer strong protection without breaking the bank.

So, while you’re taking care of business at work, mum’s life insurance from Chimat can help ensure your family’s future at home.

Stay-at-Home Mums: Valuing In-home Contributions

Stay-at-home mums do a fantastic job every day. They cook, clean, and take care of the kids. Their work at home is very important but often goes unnoticed when considering life insurance.

If a stay-at-home mum was injured, the family would have to pay someone else for childcare and all her work. Hiring help costs a lot of money, money many families don’t have.

That’s why stay-at-home mums need life insurance, too. According to experts like Child Poverty Action Group, it can cover the cost of childcare, which is high over 18 years—£157,562. Life insurance can also give the family some income if Mum is not there anymore.

Older Mums: Insurance Options Later in Life

Life insurance is still an option for older mums. It ensures that your loved ones are cared for, even when you’re not around.

If you’re an older mum, you might worry that getting a good deal on life insurance is too late.

However, many companies offer policies designed for people later in life. These can help cover funeral costs or leave some money behind as a gift for your children or grandchildren.

As we age, our needs change, and so does the type of cover we might need. You may want to consider how long the policy should last and what expenses it needs to pay off, like any debts, or maybe help with the grandkids’ future education costs.

Click To Compare QuotesChimat can help you find plans that fit your budget and give you peace of mind knowing everything is handled.

Expectant Mums: Applying During Pregnancy

If you’re pregnant, it’s a great time to get life insurance. It gives your growing family extra safety. You can set it up now so that if anything happens to you, your baby and family will have money to help.

This is thoughtful planning for their future.

Having a baby means many new costs. Life insurance can also cover these things. Many mums like knowing they’ve got this sorted out early in pregnancy.

It’s easier than you might think, and we’re here to help every step of the way.

Determining the Right Level of Cover for Mums

Every mum’s situation is unique, from deciphering financial commitments to planning for her little one’s future education. It’s all about getting the cover that fits snugly around her family’s needs.

Assessing Financial Responsibilities and Debts

As mums, we know how important it is to monitor our finances and debt. This helps us choose the right amount of life insurance.

With an average personal debt of £34,566 in the UK, not counting a mortgage, many of us may have credit cards or loans to pay off.

If anything were to happen to us, these debts could be left for our family to deal with. So when choosing life insurance coverage, consider all you pay for – from daily living costs to bigger things like your home loan.

Life insurance can protect your family financially if you’re no longer there. It can help with funeral expenses, which cost around £3,953 on average, and other debts.

That way, you leave peace of mind instead of worries over money. Plus, it’s one less thing for loved ones relying on inheriting something for their retirement funds; including this in your plan means they won’t miss out on any comfort they might have expected from you.

Planning for Future Education and Childcare Costs

We know how important our kids’ futures are. Planning for their education and childcare is a big part of our work.

Looking ahead, the costs can seem scary. But with life insurance in place, we can ensure our children have the money they need for school and care if something happens to us.

Putting aside enough to cover tuition fees or nursery bills isn’t easy, but it’s worth it. Families like ours spend a lot on these essentials every month.

We’re taking a huge step towards protecting our children’s dreams by choosing life insurance that factors in future learning and growing-up costs.

And when those dreams turn into degrees without the worry of student loans hanging over their heads, we’ll know all this planning was perfect.

Adjusting Cover with Changes in Family Size

Your life changes as your family grows or gets smaller, and so must your life insurance. More kids might mean you need more cover to pay for school and food if you’re not around.

If the children leave home, you might not need as much cover. Checking your policy when big changes happen in your family is wise.

Family life insurance is flexible and can change according to your family’s needs. It could be time to talk about updating your policy if you have a new baby or one of the kids starts their own adventure away from home.

Practical Aspects of Life Insurance for Mums

In exploring the practical aspects of life insurance for mums, we must be honest about the costs.

It’s time to dispel the myth that premiums are too pricey—affordability is key. Let’s talk about setting up your policy in trust; it’s a savvy move that ensures your little ones benefit directly.

And what about after divorce? It would be best to keep that protection in place for peace of mind.

Costs Involved: Debunking the Expense Myth

Many people think life insurance is too expensive, but that’s false. I can find great deals starting from just 20p a day—less than you’d spend on a small snack. Getting the protection you need won’t break the bank.

Prices change based on factors such as how old you are and if you smoke. But whatever your situation, I will search around to get you the best coverage at a price that fits your budget.

Policy in Trust: Ensuring Direct Benefits to Dependents

Putting your life insurance policy in trust can be a smart move. If something happens to you, the money goes to your chosen people—like your kids or partner.

This can help ensure they get financial support quickly without waiting for legal paperwork. Also, having your policy in trust often means it doesn’t count for inheritance tax, so more of the money goes where you want it.

We know how important family is to mums. That’s why we suggest putting your life insurance in trust as part of caring for them.

It’s one way to help give them a secure future and remove worries about what will happen if you’re not around.

Divorce and Life Insurance: Maintaining Protection Post-Separation

Life can take unexpected turns, and divorce is one of those significant changes that can affect everything, including life insurance.

If you’ve split from your partner, looking at your life insurance policy is essential.

You might need to cancel a joint policy or start one that fits your new situation. Remember that if you have children, ensuring their financial protection is critical.

Sorting out life insurance after a divorce is part of caring for yourself and your kids. You may want to set up the policy so the money goes straight to your children if something happens to you.

Additional Covers to Consider

We should consider additional cover like Critical Illness and Terminal Illness Cover to protect against severe health issues.

Income Protection is another option, ensuring our family’s finances remain stable during periods of illness or incapacity.

These add-ons can provide comprehensive support beyond the basic life policy, ensuring all bases are covered for our peace of mind and our family’s security.

Critical Illness Cover: For Serious Health Issues

Let’s talk about critical illness cover. If you or another mum gets very sick, like with cancer or a heart attack, this insurance gives you money to help out.

It can pay for your family’s needs or extra medical care if you cannot work.

We all hope never to need it, but having that safety net means one less thing to worry about.

Critical illness coverage is really important for mums. If we ever get seriously ill, it can give our families a big lump of money.

That way, they can keep paying bills and not worry so much about money when dealing with health worries.

Terminal Illness Cover: Preparing for the Worst-case Scenario

We all hope for the best, but sometimes life can throw tough challenges. If a mum gets very sick and learns she cannot get better, Terminal Illness Cover will help.

This cover means that if doctors say a mum only has a short time left, the insurance could pay out money early.

This money can be used for anything needed—paying bills, making family memories or ensuring everyone is okay.

Adding Terminal Illness Cover to our life insurance is another way we protect them, even when facing hard times ourselves.

Income Protection: Sustaining Family Income during Illness

Mums, life can throw curveballs, like getting sick and unable to work. It’s hard to think about, but what would happen if you were ill and couldn’t bring in money?

Income protection is a type of insurance that pays you some cash when you can’t earn your normal paycheck due to sickness or injury.

This means bills still get paid, and the kids are cared for while you focus on getting better.

Think of income protection as a safety net for your wallet. If illness stops you from working, this cover will help keep things running at home.

It pays out a regular sum that helps cover daily costs until you’re healthy enough to return to work or until the policy ends.

Life Insurance Application Tips for Mums

Importance of Honest Health Declarations

When applying for life insurance, we must tell the truth about our health. If we don’t, our family might not get the money from the insurance after we are gone.

Let’s say someone has asthma and doesn’t tell their insurance company.

Later, if something bad happens because of their asthma, the company may not pay to help the family.

We must disclose all our medical conditions and lifestyle choices, even if it means paying more now.

This way, we care for our families by ensuring they’ll have what’s promised later.

Insurable Interest for Single Policies

We know that life insurance is important for mums. It helps to ensure our kids and family are okay if something happens to us.

We must show the insurance provider that someone will miss us financially if we’re gone. This is called insurable interest.

For single policies, our children or anyone dependent on us for money would feel the loss if we weren’t there anymore.

So, when looking at quotes or discussing cover options, let’s focus on those who count on our support daily.

They are the ones who matter most in proving insurable interest and getting the right policy set up just for us and them.

Comparing Quotes: Finding Affordable Options

It’s wise to look at different quotes for life insurance. This way, we can find the best deal for our budget and needs.

We want something that won’t be too hard on our wallets but still gives us good cover.

The Chimat Life team will check different life insurance quotes to ensure we’re not paying too much. This will also help us see all the options and pick what works best for us as mums.

Some companies might offer lower prices or extra benefits that are perfect for our families.

It’s like shopping around before buying a new fridge or phone – you want great value without spending more than you have to.

And remember, if things in our lives change, like having another baby or moving house, it’s important to recheck those quotes.

Mums Life Insurance, Some Final Thoughts

Every mum’s greatest wish is to know her family can thrive even in her absence; life insurance is a silent promise they will.

It’s more than just a policy—it’s the comfort of stability and the assurance of continuity for those she cherishes most.

By choosing the right life insurance, mums across the UK cement a legacy of care and security, wrapping their love around their families like a shield against life’s uncertainties.

It’s about making sure bills get paid, dreams don’t have to change direction, and daily life can go on even when times get hard.

Questions Mums Often Ask Us:

1. What is term life insurance for mums?

Term life insurance for mums is a type of policy that pays out if the mum passes away during a set time. It helps cover child maintenance, mortgage debt, and living costs.

2. Can single parents get joint life insurance policies?

Yes, even single parents, including Dads, can buy a joint life insurance policy with someone else, but it usually pays just once after one person on the policy dies.

3. How does quitting smoking affect life insurance premiums for mums?

If a mum stops smoking, her life insurance premiums might go down because she’s seen as less at risk of health problems.

4. Should mums get financial advice before buying life assurance?

Absolutely. Mums should get advice to understand what type of cover—like level term or whole-life—best suits their needs and family situation.

5. Why is medical underwriting necessary in getting health insurance for mums?

Medical underwriting checks a mum’s health to decide how much her health or life assurance will cost and whether she’ll need to pay more due to higher risks.

6. Can primary caregiver mums use trusts to manage life insurance payouts?

Yes, trustees can help manage the payout from a mum’s policy so it goes correctly toward things such as mortgages or education fees for her kids.

It gives us peace of mind today, knowing their tomorrows are protected too.

7. Are Mum’s and women’s Life insurance the same type of policy?

Women’s life insurance policies and mums’ life insurance are generally the same, specifically marketed towards mothers and single mums.

8. I’m a disabled Mum. Is it still possible for me to take out a life insurance policy?

Even if you’re a disabled mum, you can still get life insurance for a disabled person in the UK. Your condition doesn’t automatically disqualify you.

Insurers assess each application individually, considering your overall health and circumstances.

I’m a young adult, Mum. Are there any benefits to me taking out coverage at a relatively young age?

Yes, taking out life cover when you’re a young person often means lower premiums and better health-based and age-based rates. It also locks in protection early, providing financial security before future risks arise.

Further resources we feel might be helpful to Mums in the UK:

- https://www.nhsbsa.nhs.uk/sites/default/files/2021-04/Family%20benefits%20and%20life%20assurance%20factsheet-20210419-(V1).pdf

- https://www.moneyhelper.org.uk/en/blog/insurance/life-insurance-for-new-parents

- https://www.bristol.ac.uk/geography/research/pfrc/themes/capability-behaviours-wellbeing/from-mothers-for-mothers/