Life insurance can provide ladies with a safety net in emergencies. Do you need life insurance as a woman?

The simple answer is yes, you do. Even if you don’t have dependents, there are considerable advantages to having life insurance for women.

Life Insurance For Women – Which is the best insurance for women?

Women’s life insurance helps secure financial stability for loved ones, often with lower premiums than men due to average life expectancy. Which is the best life insurance for women? That depends on age, health, and the level of cover needed.

- ✔ Women aged 50+ or 60+ can access fixed premiums and guaranteed acceptance with over 50s life cover

- ✔ The cheapest life insurance for women often comes from term-based policies, especially when taken out young and healthy

- ✔ Whole life insurance ensures a guaranteed payout, ideal for long-term peace of mind

- ✔ Joint life insurance may cost less for couples but pays out on the first death only

- ✔ Mums with young children often choose family protection cover to safeguard dependents

What Is Life Insurance for Women?

In this guide, we explain the importance and benefits of life insurance and help you discover the best insurance options available.

Don’t worry. Getting a policy is faster and more affordable than you think, and Chimat can offer plans from only £6 per month, depending on factors such as age and health considerations.

Women’s life insurance encompasses different types of policies that are better suited for ladies.

In general, life insurance coverage is always tailor-fit to your circumstances. This means life insurance can have different prices based on your gender.

Cover Starts from only £6 per month. Compare offers from leading UK insurers

Here are a few factors that contribute to the average life insurance rate for women:

- Average Lifespan: The average lifespan of women in the UK is significantly longer than that of men. This can positively affect the final price of a life insurance policy.

- Medical History: Some illnesses, like breast cancer, are specific to women. You’ll want to get a policy from a specialised insurance company to avoid extra medical expenses.

- Household Contributions: Sometimes, the woman may be responsible for handling household expenses and childcare. Insurance agencies consider your household contributions and advise you on the best policies.

Life insurance for women takes into account all these factors. It aims to provide a safety net for unexpected expenses, rescuing your family from financial strain.

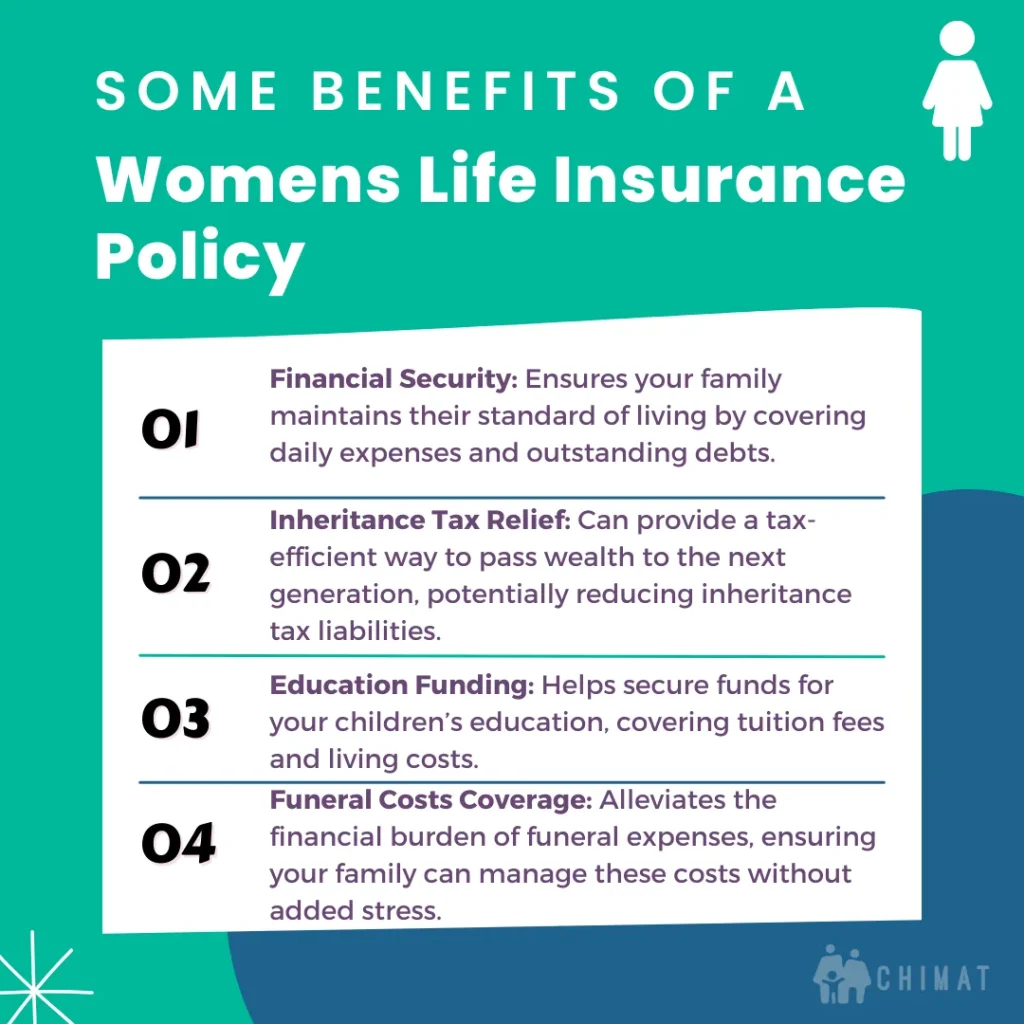

Why Do Women Need Life Insurance Coverage?

Today, more women are bringing home bigger cheques than their counterparts. Yet, according to Forbes, only 47% of women have life insurance compared to 58% of men.

The reason for this may be due to the misconception that only primary breadwinners need life insurance.

In reality, whether you’re a breadwinner or a woman with no dependents, there are advantages to getting insurance. Below are a few reasons why.

Terminal or Critical Illness Coverage

Aside from a death benefit, some policies offer illness coverage. So, you can get early cash benefits through life insurance if you’re diagnosed with a critical illness.

Click To Compare QuotesThis is helpful because you may use the funds to cover your medical bills. It can lighten the financial load for you and your family.

Life insurance coverage can serve as a valuable retirement supplement for men and women alike.

Mortgage Costs

Unfortunately, your mortgage doesn’t end when you pass away. Some mortgage lenders require insurance before contract signing.

Life insurance ensures your mortgage and any unsecured credit continue to get paid even after your death. It can also help pay for the taxes your next of kin might have to pay for the sale of your property.

Getting mortgage life insurance is great, especially if you have dependents and other family members.

Funeral Costs

It’s understandable if you don’t want to think about your death. However, preparing for it can help your family in the long run.

According to the Gazette, the average funeral cost in the UK is £9,658 in 2025.

Only 54% of people prepare for their funeral expenses. As a result, the families they leave behind must pay for the funeral costs.

Having life insurance can ease the adjustment period for your loved ones and set them up for a future without worry.

Family Lifestyle Coverage

People estimate that stay-at-home mums do more than £26,000 worth of chores yearly. On top of this, they also earn an average yearly salary of £34,718.

There’s no doubt that women contribute to a family’s financial stability.

Click To Compare QuotesWhen you’re gone, your loved ones may struggle with the additional cost of maintaining their lifestyle. The equivalent price of external childcare alone can reach over £300 a week.

As a woman, it’s vital to consider your family’s quality of life. Even a small life insurance policy can significantly improve their daily activities.

College Savings

The Department of Education estimates that childcare in the UK costs £300 a week. Yet, that’s not all your family has to pay if you get into an accident.

You should also consider family finances in a few years. For example, your kids may need funds for their college education, which can cost anywhere from £11,400 to £38,000 per year.

The good news is that women can get life insurance that covers college tuition. Thus, you no longer have to worry about sending your children to college even after you’re gone.

How to Get Life Insurance for Women in the UK

Life insurance is surprisingly accessible and affordable for women. Here’s how to begin:

Learn About Your Options

First, you should contact an insurance company or brokerage to determine your options. Having a goal and determining the insurance beneficiaries helps.

During this process, you may have to answer questions about your age and medical history.

It would be best to inform the agent about any risks you encounter at work or through hobbies.

Receive a Quotation

Your information lets insurance companies propose the best policy for your needs. They’ll offer a quotation and run you through the nuances of the policy.

Our tip is to compare quotations from different insurance firms. Each insurance company has its specialities and perks, so you should take advantage of the options.

Contacting an insurance brokerage gives you access to various companies at no extra cost.

Pay for Monthly Dues

Once you find the best type of insurance for your needs, sign the contract and pay the monthly fees.

The monthly fees depend on your circumstances, but plenty of affordable options exist. You have to continue making your payments until the end of your term.

Finally, remember to review and update your insurance policy whenever you experience significant life changes.

What Is the Best Life Insurance Policy for Women?

The best life insurance for a woman depends on her circumstances. To get maximum benefits, you’ll want to know your goals and needs.

Here are a few factors you should consider:

- Insurance Duration: Insurance can be permanent or temporary. For those with underage children, term coverage may be ideal, as it lasts until they become independent.

- Dependents: There are special policies for women with children, dependent parents, and partners. The best policy will cover all of your loved ones.

- Flexibility: Insurance coverage isn’t one-size-fits-all. The best life insurance policy is flexible and can meet your needs.

- Ease of Attainment: Have other life insurance companies declined you? The best brokers will help you through your struggles and make obtaining insurance easy.

| Subject | Details |

|---|---|

| Coverage Options | Term Life, Whole Life, Over 50s, Mortgage Cover |

| Special Considerations | Maternity coverage, pre-existing conditions, medical exams, and final expense needs. |

| Benefits | Affordable premiums, financial protection, and legacy planning. |

| Common Providers | Legal & General, Aviva, AIG, SunLife, Royal London, LV=, and Saga. |

| Policy Terms | 5 to 30 years, with monthly and annual premium payment options. |

Types of Life Insurance Policies

What types of life insurance can you expect when you contact an insurance agent? Here are a few life insurance basics you should be aware of.

Life Insurance for Mums

Mum’s life insurance protects your loved ones from unnecessary financial hardships. Getting one is an act of love and empowerment.

Today, the cost of raising a child is £160,692 for a couple and £193,801 for a single mother. If you have dependent children, you must ensure they’re always financially cared for.

Life insurance for mums can cover the cost of raising a child. Depending on your plan, it may include housing, food, education, clothing, and childcare. Some health insurers can also cover delivery, maternity, and baby care costs.

You may want to update your policy each time you welcome a new child to the family.

Term Life Insurance for Women

A term life insurance policy provides death benefits for only a specified period. Depending on your plan, some last for 10, 20, or 30 years.

Term policies are beneficial for women with certain goals. For instance, it’s great if you want to get insurance while your children are growing.

Simply put, a term life policy is for those who want to stop paying for insurance once their kids become independent.

For some, a term life insurance policy is better because it’s cheaper than permanent coverage. You may also renew it for an additional term if you change your mind.

Whole Life Insurance for Women

In contrast to term insurance, whole life insurance, also known as permanent insurance, provides coverage for your entire life. The permanent policies suit those who don’t want any guesswork regarding their death benefits.

Click To Compare QuotesYou can pick a whole life insurance that pays dividends yearly, and the premium payments shouldn’t go up. Moreover, paying for a set number of years is an option. No more payments are required after you finish paying for the policy.

With permanent insurance, you can designate a percentage each beneficiary will receive. You may need to provide details about yourself, such as your medical and criminal history.

That said, we highly recommend getting a permanent life insurance policy.

Life Insurance for Women Over 50s

Women over 50 have many life insurance options to consider. Some companies won’t ask you to answer health questions or take a medical exam. Others offer coverage from only £6 per month, depending on your age.

This type of insurance gives your beneficiary a fixed cash payout between £25,000 and £1,000,000 when you pass away.

Insurance for women over 50 may help you after your retirement. It can fund your lifestyle even when you get a terminal illness. Plus, it can pay off small loans, funeral costs, inheritance taxes, and mortgages.

Joint Life Insurance for Women

Joint life insurance covers two people instead of one. It’s perfect for married couples and business partners.

There are two types of life insurance plans. You may choose to get the death benefit when the first person dies. Another option is to get the benefit only after both parties die.

In the latter case, the remaining individual must continue paying life insurance premiums. Afterwards, the benefit goes to the couple’s beneficiaries.

Joint life insurance is typically more affordable than getting two separate plans.

Life Insurance for Single Women

Having insurance is advantageous even for single women without dependents. This type of insurance is usually used to cover funeral costs.

When the unexpected happens, your remaining family may have to pay for your funeral, credit or card debt. You may also have pets needing financial support for years after your death.

Life Insurance saves your family from financial worry. It may even provide them with a small monetary gift.

Don’t worry. Insurance for single women has lower costs compared to other types of coverage.

Life Insurance for Women With High BMI

Insurance companies often ask about your weight and height to compute your body mass index. This is because those with a high BMI have a higher risk of diabetes, heart disease, and hypertension.

Unfortunately, an insurance company can reject your application based on your BMI. They can also give you a pricier policy than necessary.

If you struggle to obtain life insurance, don’t worry; we’re here to help. We believe that women with high BMIs have the right to get affordable insurance.

With proper insurance for women with high BMI, you can receive the support you need and get access to valuable resources.

Life Insurance for Specific Jobs

Did you know you can get life insurance specific to your occupation?

Occupation can affect the price of your premium. For example, if you’re a science or woodworking teacher, you may be handling dangerous chemicals or heavy machinery.

Getting insurance for teachers ensures your activities will be included in your policy.

There are also policies available for women working as nurses. Nursing is a high-risk job, as you may get exposed to infectious diseases and toxic chemicals.

This type of insurance makes it easier to cash out when you are involved in an accident due to your professional duties.

Life Insurance for Pregnant Women

Can you get life insurance when you’re expecting? The quick answer is yes, you can.

Your pregnancy should not affect the cost of getting insurance. Pregnancy is a short-term event that won’t significantly affect insurance plans.

Nevertheless, there are a few key points to note.

First, you have to disclose that you’re expecting, as a pregnancy has its risks. On top of this, you must mention any health issues relevant to your pregnancy.

When you’re pregnant, you may get illnesses like anaemia, high blood pressure, and gestational diabetes. Full transparency is necessary so your beneficiaries can get their payout without issues.

Tips for Getting Life Insurance When Pregnant

Here are a few tips for getting life insurance for expecting mums.

- Disclose Alcohol Consumption: When you’re pregnant, you may stop drinking or smoking. Still, it would be best if you told the insurance provider about any drinking and smoking habits before pregnancy.

- Secure New Policies: Consider updating your policy each time you welcome a new member to the family so you can cover everyone as your family grows.

- Be Transparent: If you had complications in past pregnancies, you must tell the insurance agency. This part of your medical history is a risk factor that your provider calculates for.

Do You Need to Report a Pregnancy If You Already Have Coverage?

No, there’s no need to tell your insurance provider about your pregnancy if you already have coverage. However, there are benefits to changing your policy to account for new children.

Sometimes, it may be better to cancel an existing policy in exchange for a better one.

Does Life Insurance Change Once You Have Children?

No. Having children doesn’t change a woman’s life insurance coverage. If you want your life insurance to cover any new kids in the family, you need to contact the insurance company.

The cost of your policy is likely to increase due to the additional dependence. Still, the rate based on other factors should remain the same.

Life Insurance for Female-Specific Illnesses

Some illnesses affect women more than men. To prepare for such cases, you can check insurance companies specialising in specific diseases and pre-existing conditions.

Life Insurance for Cancer in Women

Several types of cancers affect women, so it’s wise to have insurance if your family has a cancer history. Cancer insurance for women covers cervical and breast cancer. It also includes ovarian, uterine, vaginal, vulvar, and fallopian cancer.

This type of insurance provides a one-time payment that you can use for treatment. You can get hospital benefits of up to £4,500 and a care advisory service. Plus, you can obtain life insurance after a cancer diagnosis.

Can You Get Life Insurance When You’re Diagnosed With Cancer?

It’s a common misconception that if you have cancer, life insurance is impossible to obtain. Yet, there are insurance companies that have plans for cancer patients.

Partnering with insurance agencies specialising in cancer can connect you to affordable plans. You don’t have to go through the whole ordeal alone.

Do You Have to Disclose Cancer to Insurers?

Yes. You should disclose your family history of cancer to insurers when you’re obtaining a new policy.

In addition, you should mention habits that increase your risk of cancer, like smoking and drinking alcohol. This allows them to offer you the most suitable plan.

How Much Life Insurance Cover Do Women Need?

How much coverage you need depends on your circumstances. Women with no dependents should have insurance coverage of at least five times their income.

Meanwhile, women with kids should get coverage at least 15 times their income. Those with businesses must also consider their company’s value to ensure its continuity.

Education, debt, and inheritance taxes influence how much coverage you should have.

This all sounds complicated and expensive. In reality, the cost of life insurance can start as little as £5 per month, and women pay lower fees on average.

Your insurance provider can guide you through how much coverage you need.

How Is a Life Insurance For Woman Premium Calculated?

Insurance companies use statistical data and other equations to determine the cost of your premium. As a rule of thumb, they consider your age, occupation, medical history, and mental health.

You can use a life insurance calculator to get a general idea of how much to expect. Remember that there’s no one equation. Insurance companies can have different prices.

When Is the Right Time to Take Out a Policy for Women?

There’s no better time than the present. You can take out a policy regardless of your age or life circumstances. There will be a suitable plan irrespective of your budget.

Having life insurance as early as possible can save you money in the long run. However, you shouldn’t be afraid to inquire about life insurance even if you have an illness.

What’s more, it’s wise to get life insurance, especially if you don’t have enough savings. An insurance policy can cover unexpected costs and give you peace of mind.

We’ll guide you through the process and help you find the best life insurance company.

Is Life Insurance Worth It?

Considering the perks and the average cost of life insurance, we believe it’s worth the investment.

Insurance gives you and your family financial strength, safety, and stability in the face of accidents. Additionally, even if you don’t have dependents, you can benefit from early payouts if you get diagnosed with a terminal illness.

As A Young Woman, Should I be Considering Coverage At This Time?

Taking out coverage early often results in much lower premiums, as you’re likely in good health and considered low risk.

Starting young also means you can lock in that affordable rate long-term, even as your life changes.

Whether you are focusing on your career, planning to buy a home, or considering starting a family one day, it makes sense to consider life insurance as a young adult.

It can also help protect loved ones from potential burdens if something unforeseen happens to you.

Womens Life Insurance Cover: Final Thoughts

Ultimately, life insurance provides your family with security in the event of a financial hardship.

Women make a significant difference to a household’s finances through childcare and bill payments. When you’re gone, your family will experience a change in their lifestyle if you don’t have savings prepared.

Because of this, you should consider getting life insurance for women even if you’re not the primary breadwinner.