Getting life insurance as a vaper can seem confusing, as many people worry about high costs or being classified the same as smokers.

There are about 2.7 million adults in the UK who use vapes or e-cigarettes, making it a common issue when applying for life insurance.

Our vaping life insurance guide will explain how vaping affects your premiums, what questions insurers ask, and how to find vape-friendly life insurance options that suit you.

Life insurance for vapers is available, and it can also be affordable with the right provider.

Can vapers get life insurance at competitive rates? Yes, but it depends on how insurers classify vaping.

- ✔ Some insurers classify vaping as the same as smoking, which can lead to higher premiums.

- ✔ Chimat works with some providers to offer vape-friendly life insurance with more flexible terms.

- ✔ Disclosing e-cigarette use is essential and undisclosed vaping can void a policy.

- ✔ The cheapest life insurance for vapers often comes from specialist brokers like Chimat.

Compare Plans From Leading Vape-Friendly Life Insurance Providers Today.

Is vaping treated as smoking by life insurance companies?

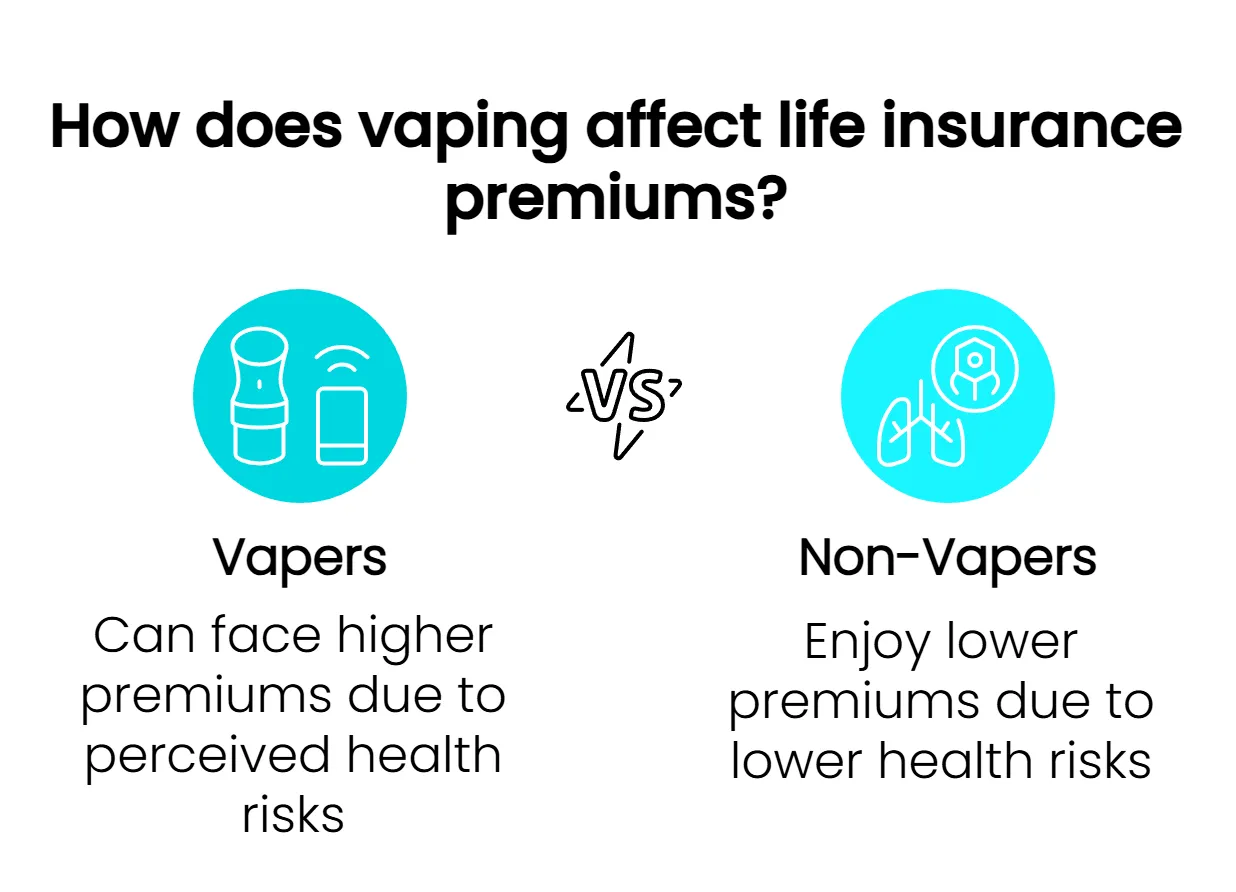

Most insurance companies treat vapers just like cigarette smokers. If you have used e-cigarettes, vapes or any nicotine products in the past year, you should expect to be classed as a smoker on your life insurance policy.

Some insurers even ask about nicotine use over the last five years.

Vaping usually gets grouped with smoking tobacco due to limited research on long-term health risks.

Providers often don’t make a distinction between smoked cigarettes and electronic cigarettes because both deliver nicotine into the blood.

Only those who have stopped using all nicotine products for at least 12 months may qualify as non-smokers and get lower premiums.

As a result, many searching for the best life insurance for vapers find that vaping can influence their rates much like traditional smoking does.

How does vaping influence your life insurance premiums?

AS mentioned above, if you use e-cigarettes or any nicotine replacement products, you will, in most cases, pay higher rates than someone who does not vape or smoke.

Life insurance for vapers often costs more than what a non-smoker pays, even if your health is good and you have never smoked tobacco.

Occasional vapers can see lower costs compared to heavy cigarette smokers, but insurers still classify you as a smoker because of nicotine in your system.

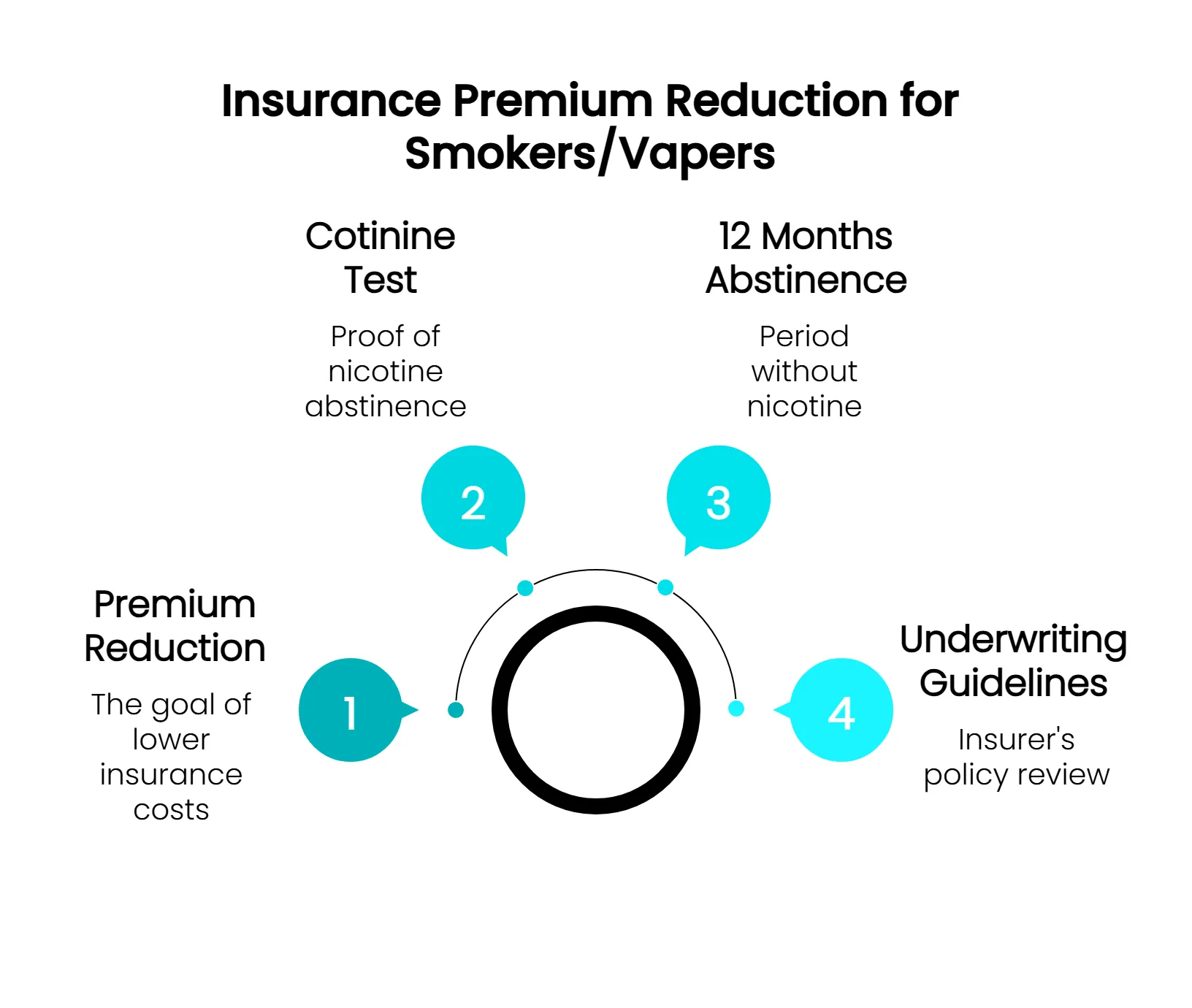

Some companies check cotinine levels during underwriting to confirm recent tobacco or vaping product use.

Click To Compare QuotesIf you stop vaping and stay clear of all nicotine products for at least 12 months, some insurers can offer cheaper rates. Until then, expect premiums similar to those of people who actively smoke cigarettes.

Should you disclose your vaping habit on a life insurance application?

Insurers in the UK treat vaping and cigarette smoking seriously, so complete honesty on your application is important.

Insurers in the UK paid 98.3% of claims in 2024, showing they trust honest answers on applications. Hiding a vaping habit may lead to a rejected payout if you die from related ailments or breathing problems such as COPD.

Insurance companies often ask direct questions about tobacco use and e-cigarette habits. They might also access your medical records with your consent to check if you have smoked or vaped.

Not telling the truth can cause problems later. Some insurers may require a medical exam during the process of getting term life cover; this may include tests for nicotine in your system from e-liquids.

If they find out you vaped but did not say so, claim rejection could be a real risk even years after buying the policy.

Always give information about current or past use of vaping products to avoid losing financial protection for things like mortgage debts and family income drawdown benefits.

Does vaping without nicotine affect life insurance policies?

Some people use nicotine-free vapes, and obviously, these devices do not contain any form of nicotine.

Some UK life insurance companies may classify users of 100% nicotine-free e-cigarettes as non-smokers.

This means you could get cheaper life insurance for vapers, with rates closer to those of non-smokers.

Click To Compare QuotesIf you vape without nicotine and can prove it, you might avoid the higher premiums paid by those who use regular vapes or smoke cigarettes.

The difference matters. A non-smoker policy can cost half as much as a smoker’s one when health is similar.

When researching vaping life insurance policies, always read each insurer’s terms before applying, as rules vary across providers, such as Aviva or Legal & General.

Does switching from smoking to vaping improve your insurance terms?

Switching from smoking to vaping or e-cigarettes may sound simple. However, some insurers still class people who vape as smokers, especially if they use e-liquids containing nicotine.

This affects your life insurance premiums as a vaper; in most cases, they will be higher.

Some providers keep an eye on new research and could become more friendly to vapers over time. Data shows that 21.1% of current smokers try vaping products to quit smoking altogether.

If you need advice about quitting smoking or vaping, NHS England services can be beneficial. This can make a significant difference when seeking the cheapest life insurance for vapers or ex-smokers.

When can you be classified as a non-smoker after quitting?

Life insurance companies in the UK often need you to be nicotine-free for 12 months before classifying you as a non-smoker.

This rule applies whether you use e-cigarettes, vape, or have given up smoking regular cigarettes.

Some insurers may ask about your tobacco or vaping history over the past five years. If you stay away from all forms of nicotine for five years, many providers offer better life insurance vaping terms and treat you as a complete non-smoker on your following policy quote.

Stopping nicotine helps improve lung function, heart, and circulation too, so it is worth pursuing if you aim to lower the risks of heart attack and secure better premiums on both life cover and pensions plans later on.

How much does life insurance for vapers cost?

The data below compares Term and Decreasing Term cover costs for vapers. The quotes are based on a £100,000.00 plan over 20 years.

| Age | Level Term (20-years) | Decreasing Term (20 years) |

|---|---|---|

| 20 | £4.19 | £3.41 |

| 25 | £5.11 | £4.15 |

| 30 | £6.95 | £4.88 |

| 35 | £9.01 | £6.73 |

| 40 | £13.15 | £9.47 |

| 45 | £20.73 | £14.52 |

| 50 | £31.58 | £24.51 |

Am I required to notify my insurer if I begin vaping?

Yes, if you commence using nicotine products after your life insurance policy is in place, it’s essential to let your insurer know.

Lifestyle changes like vaping may impact your coverage, and failing to disclose them could put your policy at risk. Staying transparent helps ensure your policy remains valid.

What is the cheapest life insurance for people who vape?

To secure the most competitive life insurance deal, it’s wise to consult with a whole-of-market broker, such as Chimat.

We have access to a broad range of providers and can guide you through the latest underwriting rules to help you secure the lowest possible premium.

Click To Compare QuotesThe lowest life insurance premiums for vapers in the UK are currently offered by specialist providers rather than standard insurers.

Most mainstream companies (including Liverpool Victoria, London, and Aviva) quote vapers in some cases double the rates of non-smokers.

However, specialists such as Reviti and Future Proof stand out for vapers:

- Reviti offers vaper-specific discounts, reportedly up to 15% cheaper than standard smoker rates.

- Future Proof claims to save vapers up to 50%, especially if you haven’t smoked tobacco for 12 months or more.

Pricing will depend on your age, health, required coverage, and details of your vaping habit, so quotes will vary by case.

Tips for negotiating premiums

Obtaining life insurance as a vaper may be more expensive than for non-smokers, but you can still try to lower your premiums. Use these tips to help negotiate better rates with insurers.

If you prefer to avoid this often time-consuming stage, the Chimat team would be pleased to work on your behalf and secure a policy that meets your requirements.

- Provide evidence of being nicotine-free, such as a report from your doctor or a clean saliva or urine test; this may support your case for lower premiums.

- If you have switched from cigarettes to vaping, explain this change to the insurer and highlight any health benefits or improvements.

- Ask if the insurer classifies vaping as smoking for life insurance, especially if you use products without nicotine.

- Negotiate by highlighting your commitment to quitting tobacco and mentioning other positive habits, such as regular exercise, healthy lungs, and a balanced diet.

Our recommended strategies to improve your insurance application as a vaper

Taking more time on your insurance application can help you secure more favourable premiums. Many providers view vaping differently, so take steps before applying.

- Document any efforts to stop smoking, for example, using the NHS Stop Smoking services, since some insurers may value this.

- Gather medical records from your GP to prove you are living a healthy lifestyle or regular check-ups, which insurers often request.

- Ask each provider directly how vaping is classified for life insurance, as definitions vary by company.

- Contact specialist brokers, such as Chimat, to compare life insurance policies and identify insurers that offer fair terms for vape-friendly policies.

Choosing life insurance as a vaper is possible

Always tell your insurer about your vaping habit, whether you use e-cigarettes or vape pens with nicotine.

This honesty can help you avoid trouble in the future. Comparing quotes from different life cover providers can help you save money, especially if you receive advice from an independent broker, such as Chimat Life.